ARTICLE SUMMARY:

The profile of device innovation in deep venous diseases seems to be rising every day. A look at the market opportunity, excerpted from our recent feature article.

The pace of medical device innovation for diseases of the deep veins is accelerating.New companies are attracting sterling investors, like Akura Medical, a second-generation venous thrombectomy company, which raised a $35 million Series B round in October 2023, and Endovascular Engineering, which, also developing a next-gen venous thrombectomy product, raised a Series A round in 2022, boasting Santé Ventures, Cordis, and a second unnamed strategic investor among its roster of investors. Noted one medical device CEO we spoke with recently, “Nearly every garage in Silicon Valley has at least one venous thrombectomy project going on.” And most of the major companies operating in coronary intervention have established a presence here by acquisition or internal development.

Inari Medical was the first company to become a fully-fledged pure play focusing on deep venous diseases with devices purposely built for the way veins are different than arteries.

Inari is specifically addressing venous thromboembolism (VTE), which breaks down to deep vein thrombosis (DVT), pulmonary embolism (PE), and post thrombotic syndrome (PTS). These diseases are often silent so they don’t have the apparent urgency of blockages in the coronary arteries or the neurovasculature, but they can be threatening to life and limb. PEs are often fatal, with 10-30% of patients dying within one month of diagnosis. At the very least, these venous conditions detract from a patient’s quality of life by causing pain, swelling, immobility, and the need for repeat procedures.

Inari estimates that 1.6 million people present with VTE in the US each year, with approximately 1 million diagnoses of DVT and 560,000 PEs. Inari describes the total addressable market as 410,000 DVT patients and 280,000 PE patients who could benefit from thrombectomy. Across applications in PE, DVT, chronic venous disease, small vessel thrombosis, and arterial thrombosis, the venous device pioneer estimates its market opportunity at $5.8 billion.

The deep venous device space finally has the high-profile success story that investors look for. Founded in 2011, Inari went public in May 2020 with an upsized IPO, the best device IPO of the year. The company raised $156 million with a market cap of $892 million, and immediately upon trading, the share price rose by 117%. Today Inari has a market cap of almost $3.7 billion. Revenues have increased by 31% for the first nine months of 2023 and company revenue guidance stands at $478-$488 million. Inari has even become a strategic acquiror, purchasing critical limb ischemia device-maker LimFlow in November, to bolt on an adjacent $1 billion opportunity that overlaps with its core physicians,

Putting some perspective around the low penetration rate for the VTE market, Inari’s CEO Drew Hykes looks back to coronary artery disease. Ppercutaneous coronary intervention entered a market that was historically dominated by conservative medical care, with some thrombolytic drug interventions. “Then, definitive catheter-based first-line interventions emerged, creating a PCI market that is probably 95% penetrated today,” says Hykes. Over the past 10 years, a similar scenario has played out in stroke: drug intervention giving way to endovascular thrombectomy. He estimates the stroke market for first-line catheter-based interventions to be about 40-50% penetrated today. Stroke, which must be treated within tight time constraints, suffers from some barriers that occur in the pre-hospital market, which hinders the growth of interventional procedures. But the treatment window for pulmonary embolism is slightly more forgiving, depending on whether it is a massive or lower risk case. Hykes says, “We think that over time, VTE is going to land somewhere between those two bookends, probably somewhere closer to the PCI end of the spectrum.”

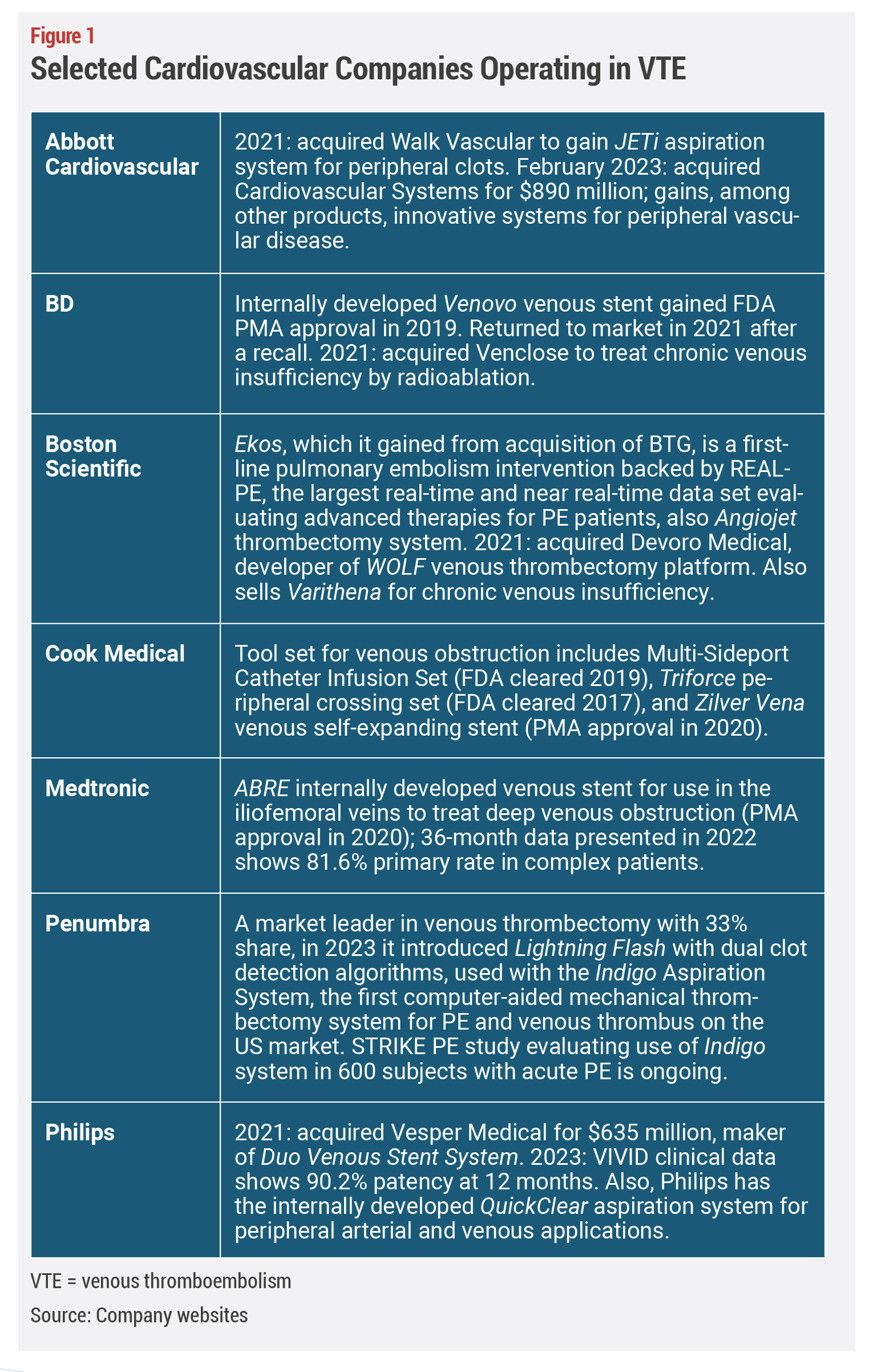

As one might expect, Inari’s success has attracted numerous new companies to the space with designs on improving thrombectomy devices, creating purpose-built venous stents, venous valve replacements, and other vein-specific interventions (see Figure 1). That’s not necessarily a bad thing for incumbents. Newcomers will bring more forces to raise awareness among clinicians and patients about the disease state itself, which is often silent until pain and swelling cause the patient to complain to their primary care doctor, and in so doing, help to change the trajectory of millions of patients who suffer today without adequate treatments.

As one might expect, Inari’s success has attracted numerous new companies to the space with designs on improving thrombectomy devices, creating purpose-built venous stents, venous valve replacements, and other vein-specific interventions (see Figure 1). That’s not necessarily a bad thing for incumbents. Newcomers will bring more forces to raise awareness among clinicians and patients about the disease state itself, which is often silent until pain and swelling cause the patient to complain to their primary care doctor, and in so doing, help to change the trajectory of millions of patients who suffer today without adequate treatments.

Subscribers, continue reading “Breakout Opportunity in Devices for the Deep Veins?” here.