ARTICLE SUMMARY:

The recent success of Insulet’s automated insulin delivery patch pump has injected new life into the diabetes market.

One of the most significant diabetes device stories of 2022 was the US launch of Insulet’s much-anticipated Omnipod 5, the first insulin patch-pump system with hybrid closed-loop automated insulin delivery (AID) capabilities. Since the launch there has been strong demand for Omnipod 5 among both existing and new pump users, impacting the competitive landscape and focusing renewed attention on the patch-pump opportunity.

Worn on the body for a period of days, tubeless patch pumps such as Omnipod are simpler to operate and have lower up-front costs than traditional tubed insulin pumps. The Omnipod 5, which further simplifies glucose management by adding an AID algorithm, appears to have struck a chord with both patients and physicians, and Insulet’s competitors are taking note. One major player in the pump field—Tandem Diabetes Care—is already shoring up its patch-pump pipeline with a deal to acquire private Swiss company AMF Medical, and there could be similar announcements in the future as competition in this space heats up.

The integrated FDA-cleared and CE-marked Omnipod 5 system consists of a small, fully disposable tubeless “pod” pump containing the SmartAdjust hybrid closed-loop AID algorithm; a Dexcom G6 continuous glucose monitor (CGM); and the  Omnipod 5 mobile app with SmartBolus calculator. The app can be accessed on the Omnipod 5 Controller or downloaded onto the user’s smartphone (currently available only for Android, although an iOS version is in development). The user fills the pump with insulin using a syringe (the device holds a maximum of 200 units) and adheres the pod directly to their skin, typically on the abdomen or upper arm. The pump delivers insulin continuously (via a tiny cannula) for up to three days (72 hours), automatically increasing, decreasing, or pausing delivery based on the user’s CGM glucose trends and their customized glucose target. (Bolus doses are not automated but are administered using the app or controller.) Once all the insulin is delivered, the pod pump is thrown away and a new one is filled and applied.

Omnipod 5 mobile app with SmartBolus calculator. The app can be accessed on the Omnipod 5 Controller or downloaded onto the user’s smartphone (currently available only for Android, although an iOS version is in development). The user fills the pump with insulin using a syringe (the device holds a maximum of 200 units) and adheres the pod directly to their skin, typically on the abdomen or upper arm. The pump delivers insulin continuously (via a tiny cannula) for up to three days (72 hours), automatically increasing, decreasing, or pausing delivery based on the user’s CGM glucose trends and their customized glucose target. (Bolus doses are not automated but are administered using the app or controller.) Once all the insulin is delivered, the pod pump is thrown away and a new one is filled and applied.

Unlike traditional tubed insulin pumps, which are typically sold as durable medical equipment (DME), the Omnipod 5 is available through US pharmacies on a pay-as-you-go basis, which is more convenient than the DME route and requires much lower up-front costs with no long-term commitment, both of which are appealing to potential users. According to Insulet, the average monthly co-pay for the system is $50 and many users pay less. The device’s relative ease of use and discrete on-body form factor also makes it particularly suitable for young children and teens.

In November, Insulet reported Q3 2022 sales results, noting that US adoption of the Omnipod 5 had exceeded the company’s expectations, with US Omnipod revenue of $238.1 million in the quarter (up 42.2% y/y) and a record number of US and total Omnipod new customer starts.

Presenting at the JP Morgan Healthcare Conference in January 2023, president and CEO Jim Hollingshead, PhD, said the company also saw a shift in the typical customer mix. In Q3, 60% of new Omnipod customers switched from multiple daily insulin injections and 40% switched from competitor pumps, he noted, whereas previously, the mix was 80/20. This suggests that Omnipod 5 may have driven some share gain in the quarter. There was also very high demand, he added, from existing Omnipod DASH users who wanted to convert to the Omnipod 5 (the older DASH system does not include the AID algorithm).

Although Omnipod 5 is currently indicated for use only by T1D patients, Insulet plans to conduct a pivotal trial this year aimed at expanding the indication to type 2 diabetes (T2D). The company is also gearing up to launch a basal-only pod aimed at the T2D population. That as yet unnamed device, currently under FDA 510(k) review, is built on the Omnipod platform but doesn’t require a controller or a CGM and delivers basal insulin over three days.

By introducing a simpler, basal-only patch pump to the type 2 market, Insulet expects to remove barriers that delay insulin therapy in this patient population and gain earlier access to type 2 patients. The company believes the basal-only device will add about 3 million potential US users to its estimated 11 million worldwide total addressable market (TAM).

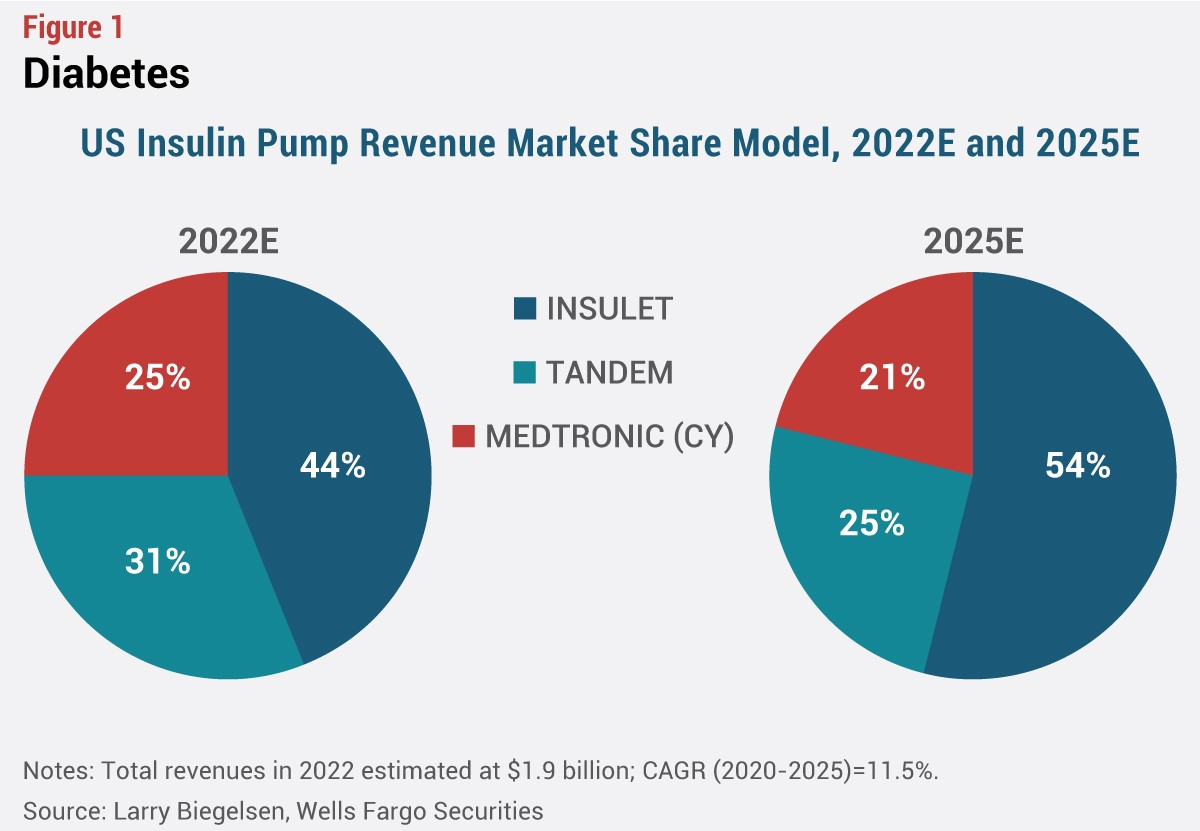

Meanwhile, Omnipod 5 could help drive substantial share gains for Insulet in the coming months. The company currently holds about a 44% share of the total US insulin pump market, according to Larry Biegelsen of Wells Fargo Securities, and could see its share increase further over the next few years.

Trial MyStrategist.com and unlock 7-days of exclusive subscriber-only access to the medical device industry's most trusted strategic publications: MedTech Strategist & Market Pathways. For more information on our demographics and current readership click here.