ARTICLE SUMMARY:

Bariatric surgery has long been a mainstay of treatment for obesity, but powerful new weight-loss drugs are upending current protocols, with downstream potential impact on treatment for comorbidities such as cardiovascular disease and sleep apnea. Boston Scientific’s acquisition of Apollo Endosurgery earlier this year reflects much of the medical device industry’s bet that “a rising tide lifts all boats.”

A new class of powerful weight-loss drugs that act on GLP-1 receptors (glucagon-like peptide-1) is gaining remarkable attention in the obesity world and could for the first time be a more viable treatment alternative to invasive surgical procedures. Clinical trials have demonstrated that these drugs, along with diet and exercise, effectively reduce weight in obese, nondiabetic patients by an average of 15% sustained more than five years—–as long as they continue on therapy—the first time such drugs have come close to surgical results.

In doing so, the drugs are ushering in a sea change in approaches to obesity and broadening interest in how scientists’ understanding of its pathology is evolving. No longer viewed as a behavioral condition at the mercy of largely ineffectual lifestyle and diet modifications, obesity is now seen as a chronic disease that responds to medicinal interventions acting on hormones that modulate hunger and satiation.

The first powerful, long-acting GLP-1 for weight loss came to market in 2021, when the FDA approved Novo Nordisk’s Wegovy (semaglutide), opening the door to widespread utilization. Originally approved in the US under the brand name Ozempic in 2017 for treatment of type 2 diabetes, Wegovy mimics the GLP-1 hormone. Potentially more potent drugs are coming, however including Eli Lilly’s widely anticipated Mounjaro (tirzepatide), currently marketed for type 2 diabetes, which the FDA is fast-tracking for a weight-loss indication. Analysts anticipate that the dual agonist that acts on GLP-1, as well as on glucose-dependent insulinotropic polypeptide (GIP) could get approved by year-end. Studies show that most people who took Mounjaro for at least a year and a half lost an average of 20% or more total body weight.

Whether prescribed on-label or off-label, these drugs have already generated billions of dollars in revenues for their manufacturers (Wegovy alone had sales of $1.7 billion in the first half of 2023), disrupting every aspect of the enormous weight-loss industry. Well-established lifestyle companies are either adjusting rapidly (Weight Watchers, Noom, etc.) or folding, as in the case of Jenny Craig. Healthtech companies, such as Intellihealth and the much younger Twenty30health, are also reacting, broadening their strategies to integrate telemedicine and compounding pharmacies into their holistic approaches to metabolic health.

The effect on medical device companies that address procedural solutions for obesity and its many comorbidities is less clear-cut. Bariatric and gastric bypass surgeries, mainstays of the field, are potentially the most exposed, but makers of devices for obesity-related comorbidities, such as diabetes, obstructive sleep apnea, osteoarthritis and other musculoskeletal (MSK) conditions, and cardiovascular diseases, also could be vulnerable, according to several analysts and device company executives who addressed the threat on recent earnings calls. Makers of sleep apnea equipment and cardiovascular devices—conditions that afflict a majority of obese people—could be impacted negatively. As one indicator, Intuitive Surgical has seen its US bariatric growth slow this year due to increased interest in weight-loss drugs, company executives said at a Wells Fargo conference in early September. Bariatric procedures account for about 4% to 5% of global Intuitive procedures, translating into annual revenue of about $300 million.

Diabetes monitoring device makers, on the other hand, particularly continuous glucose monitors vendors and aesthetics companies, are expected to thrive. In MSK, degenerative conditions, while exacerbated by obesity, take longer to manifest, so any impact would occur down the road, analysts predict. Anti-obesity drugs could even expand eligibility for some orthopedic procedures by removing certain high-BMI patients from high-risk categories that make surgeons hesitant to operate on them.

Patients’ preferences vary widely, although many obese candidates for surgery are opting instead for medication management, and surgeons are “fearful” of losing business, observes Osama Hamdy, MD, PhD, medical director of the obesity clinic and the inpatient diabetes program at Joselin Diabetes Center, a unit of Beth Israel Lahey Health. Hamdy, who spoke on the impact of GLP-1s during a webinar organized by BTIG on September 7, supervises treatment of more than 1,000 diabetic and obese patients annually, and is a leading researcher on the impact of weight loss on morbidity. Over the years, he has been involved in high-profile studies demonstrating that even very modest weight loss by obese people has a significant impact on vascular endothelial function. This improvement has potential to impact progression of atherosclerosis, coronary artery disease, and risks of stroke and heart attack.

Recent studies have strengthened these findings. Top-line results from the SELECT trial, a high-profile Novo Nordisk-sponsored study of 17,604 obese or overweight, nondiabetic adults with cardiovascular disease, announced in August, found that once-weekly subcutaneous semaglutide administered as an adjunct to standard of care reduced MACE (major adverse cardiovascular events) by 20% compared with placebo.

Still, Hamdy noted, some patients who opt for medication change their minds, and the cost benefits of the drugs have yet to proven. At a price of roughly $1,000 a month, the expense becomes burdensome, especially since the drugs must be taken continually to sustain weight loss, and insurers generally dare not cover their use for this indication. In aggregate, the cost of GLP-1s for weight loss over two years is roughly equivalent to surgery, but the drugs are ultimately more expensive because they must be taken continually to maintain the weight loss. While the downstream positive impact on spend for treatment of comorbidities, hospital admissions, and emergency room visits, etc., has the potential to offset that expense, the health economics analyses needed to confirm this expectation has yet to be done—and private insurers tend to diminish long-term beneficial trade-offs because their membership turns over too rapidly.

Yet, the potential for systemic long-term savings is alluring. For example, Hamdy points out, studies clearly show that weight loss improves cardiovascular outcomes. One of the major complications of obesity is congestive heart failure, which often leads to multiple hospital admissions and visits to emergency rooms. Every hospital admission costs roughly $13,000, so if weight reduction lowers hospital visits, the financial benefits to healthcare systems will accrue—–although the exact savings have yet to be quantified(see sidebar 1, “Health Plans Grapple with the Economics of GLP-1s”).

Sleep apnea is another example. About 70% of overweight and obese people suffer from sleep apnea, which is a mechanical problem. It is also one of the first comorbidities to improve with weight losses of 10% or more, Hamdy says. “I see people come off C-PAP once they get to that point, and cardiovascular outcomes clearly improve with weight loss”.

Boston Scientific’s Bet on Noninvasive Procedural Approaches

Regardless of excitement about the drugs, surgeons and makers of bariatric and other surgical devices for obesity say that any negative fallout for them from patient preferences for the GLP-1s is temporary and, in the long run, they stand to benefit from the increased patient engagement with providers.

The underlying prevalence of these conditions is so widespread that the impact on device-intensive procedures that target these conditions, including sleep apnea, cardiovascular disorders, and musculoskeletal disorders, will be minimal in the long term, although a short-term dip could occur as patients and providers evaluate their options, points out Wells Fargo equity analyst Larry Biegelsen in an August 8 report. Further, he notes historical trends, such as when pharmaceutical innovations like statins (dyslipidemia/coronary artery disease) were launched 30 years ago or more, they did not dampen medical device sales, as the incidence and prevalence of cardiovascular disease continued to grow.

Some surgeons have reported a short-term dip in bariatric procedure volume since the FDA approval in 2021 of Wegovy, but this is likely temporary, given obstacles to accessing the new medications, costs of long-term use, and the huge unmet clinical need for treatments, says Marina Kurian, MD, president of the American Society for Metabolic and Bariatric Surgery (ASMBS), and a surgeon who directs the weight management program at NYU Langone.

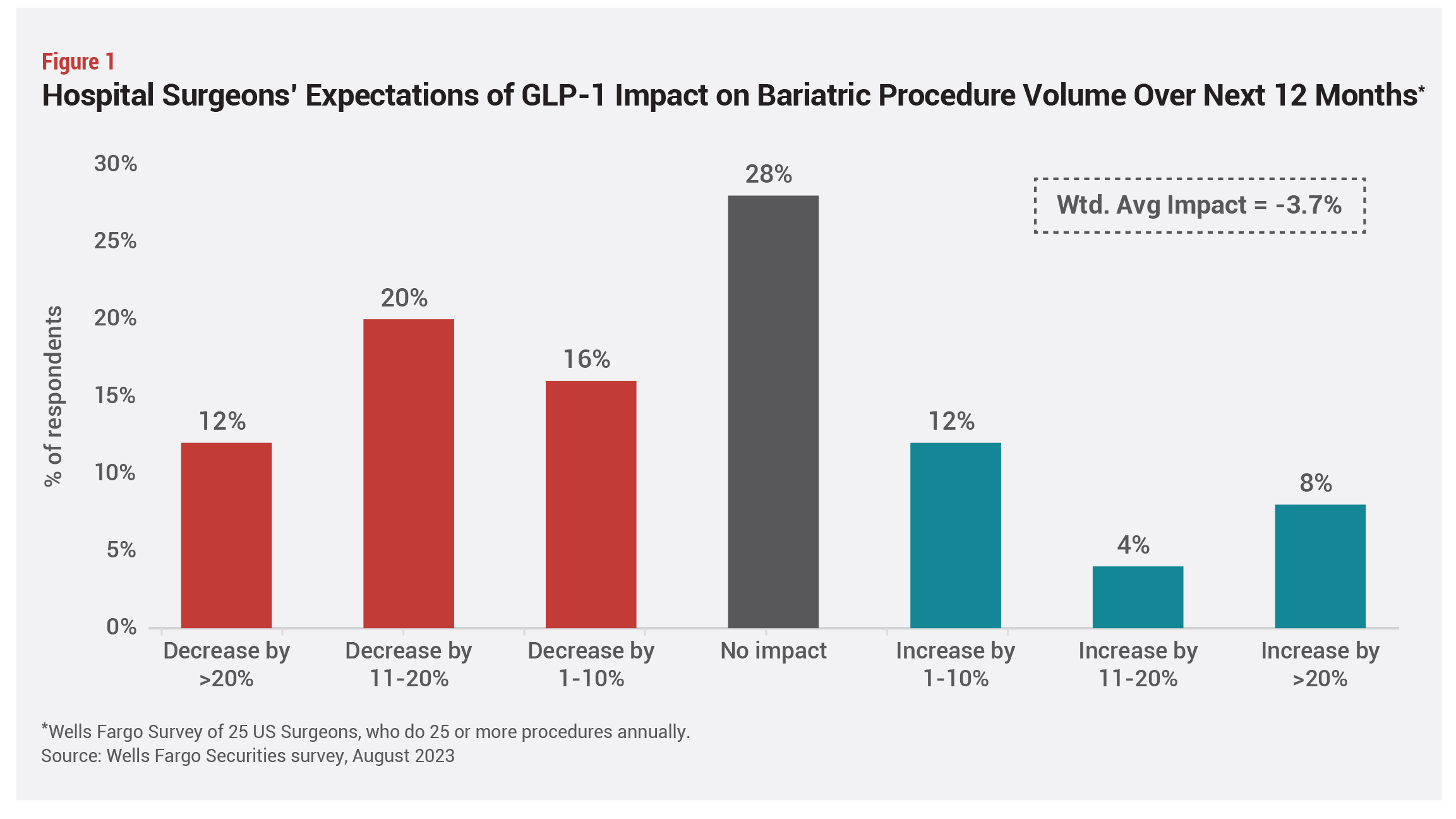

Bariatric procedure volumes were flat in 2022, the first full year any GLP-1 had been on the market with an FDA-approved weight-loss indication, but the outlook for 2023 is uncertain, she continues. “In the long term we [surgeons] will be fine,” she insists (see Figures 1 and 2).

“It is fantastic that everyone now acknowledges that obesity is a disease, and clinicians understand that the way people feel on these medications is completely different than from when they diet and exercise, but we are not there yet,” Kurian says. “Surgery is still more effective at improving TBWL [total body weight loss] than medication, although drugs in the pipeline seem like they will achieve results similar to those obtained by surgery.”

“It is fantastic that everyone now acknowledges that obesity is a disease, and clinicians understand that the way people feel on these medications is completely different than from when they diet and exercise, but we are not there yet,” Kurian says. “Surgery is still more effective at improving TBWL [total body weight loss] than medication, although drugs in the pipeline seem like they will achieve results similar to those obtained by surgery.”

The introduction of more effective medications and accompanying promotional activity opens opportunities for many more obese people to engage with the healthcare community, exposing them to the full armamentarium of options and creating a “rising tide that lifts all boats” for manufacturers, says Boston Scientific, Endoscopy Chief Medical Officer Brian Dunkin, MD, an endoscopic surgeon who previously directed endoscopic surgery at Houston Methodist Healthcare System.

The introduction of more effective medications and accompanying promotional activity opens opportunities for many more obese people to engage with the healthcare community, exposing them to the full armamentarium of options and creating a “rising tide that lifts all boats” for manufacturers, says Boston Scientific, Endoscopy Chief Medical Officer Brian Dunkin, MD, an endoscopic surgeon who previously directed endoscopic surgery at Houston Methodist Healthcare System.

Currently, most people avoid surgery, Dunkin says, noting that of the addressable market of roughly 100 million adults in the US with body mass indices (BMIs) between 30 and 50, less than 0.2% have received surgical treatment. “What’s exciting now is that we are starting to fill that gap between lifestyle modification, which has not been significantly effective, and surgery, which a large percentage of the public does not want, and medications are helping to do that.”

Earlier this year, Boston Scientific bought Apollo Endosurgery, a maker of endoscopic devices for weight loss as a treatment for obesity and other gastrointestinal conditions, for $615 million, fully aware that medication management of obesity is improving dramatically. The acquisition enables the company to expand its $2.8 billion endoscopy business into endoluminal surgeries, including noninvasive weight-loss procedures for obese patients. “Obesity is a chronic disease that requires lifelong management, even for bariatric patients, who tend to regain some of their lost weight over time,” Dunkin explains. “The same is true of medication management—although how much weight is regained is still to be determined. We need more, not fewer, treatment options. ”

”

Apollo makes the only FDA-approved endoluminal bariatric devices, including for ESG, and endoscopic revision surgeries, Dunkin says. ESG is indicated for adults with BMI of greater than 30 who have not been able to lose weight or maintain weight loss through more conservative measures, such as diet and exercise. The incisionless, outpatient procedure takes 60 to 90 minutes and utilizes an endoscope suturing system that reduces the stomach size by 70% to 80%, allowing the patient to feel fuller faster and eat less. Studies also suggest it delays gastric emptying, which may alter appetite-related regulatory pathways. The company’s endobariatric sales in 2022 were $54 million from endoluminal surgeries, of which about 40% was for ESG procedures or bariatric revisions (total revenues in 2022 were roughly $76 million, which in addition to endoluminal surgeries, included about $22 million from intragastric balloons). Both the treatment and revision systems can be used with dual-channel (Apollo ESG and Apollo REVISE) or single-channel endoscopes (Apollo ESG Sx and Apollo REVISE Sx).

Results of the Multicenter Endoscopic Sleeve Gastroplasty Randomized Interventional Trial (MERIT) study published in The Lancet in 2022 showed that patients who underwent ESG utilizing Apollo’s OverStitch Endoscopic Suturing System achieved a mean total body weight loss of 13.6% at 12 months, versus a mean of 0.8% for th control group that underwent a medical monitored regimen of diet and healthy lifestyle. In addition, more than 80% of the ESG group demonstrated improvement in one or more metabolic comorbidities. The principal investigators were Erik Wilson, MD, University of Texas at Houston, and Barham Abu Dayyeh, MD, Mayo Clinic.

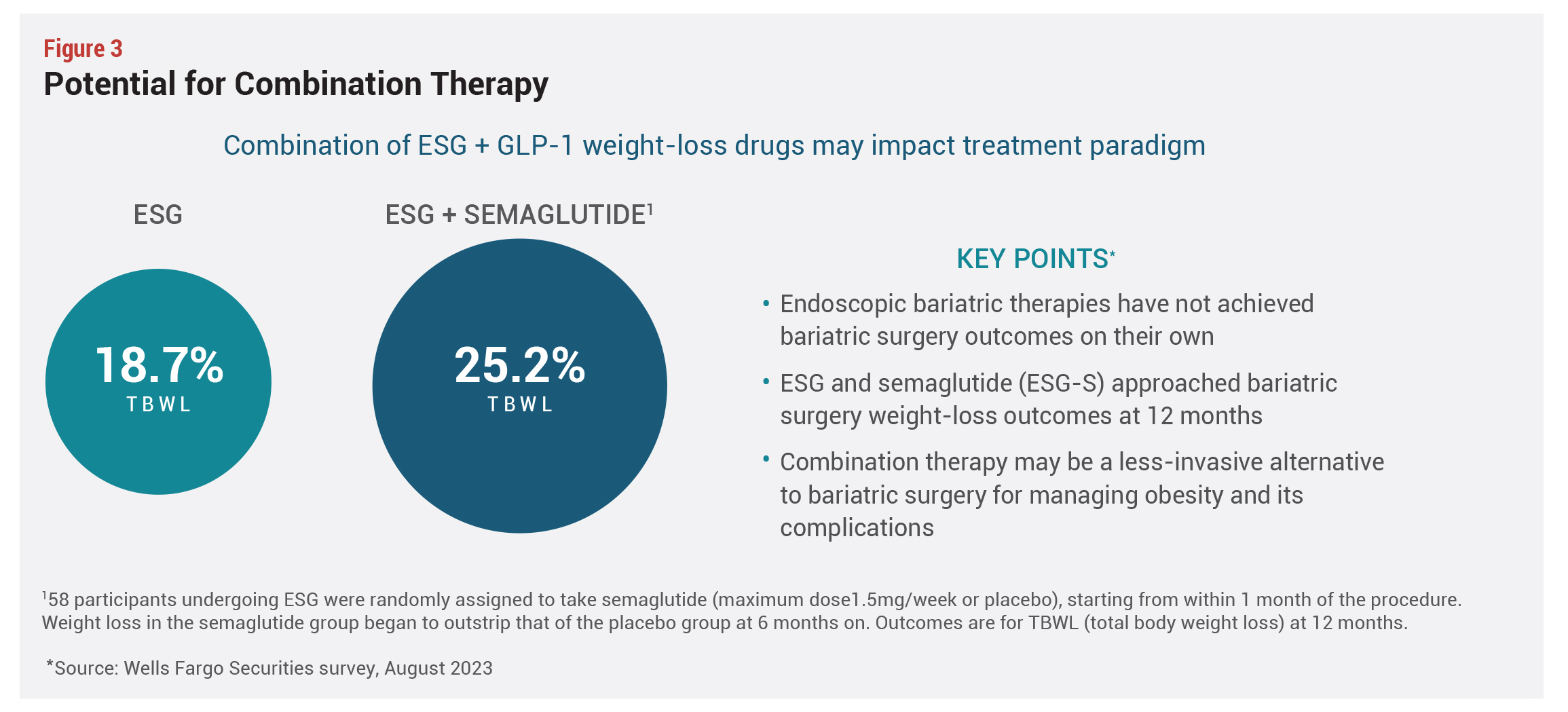

Results are comparable to semaglutide, but not as compelling as bariatric surgeries, but the potential exists for combination therapies that are more effective than any approach alone. A small study of 58 ESG surgery patients demonstrated that the procedure combined with semaglutide achieved 25.2% TBWL, compared with 18.7% for those who had ESG alone—results that approach bariatric surgery outcomes—but this data must be replicated in much larger-scale trials (see Figure 3).

Meanwhile, the field is evolving rapidly, with clinicians taking different approaches, based on circumstances, individual preferences, and rapidly emerging data. “Some people pull out all the  stops, combining procedures and medications to maximize weight loss as early as possible, and then withdrawing some of the care as the patient improves. Others advocate for a stepwise or sequential approach moving from one therapy to the next option,” says Dunkin, noting that strategies depend partly on clinicians’ understanding of obesity pathology. While any patient with a BMI of 30 or greater is eligible for ESG, it’s still too early to determine the best protocols. Either way, he adds, the expansion of the toolkit provides physicians with an “opportunity to individualize treatments for patients then work out best pathways.” And Boston Scientific continues to invest in new surgical technologies for treating obesity, including work on Axios, a lumen-opposing metal stent, which connects the stomach to other structures in the abdominal cavity and could bypass the stomach intestine downstream to get a metabolic effect.

stops, combining procedures and medications to maximize weight loss as early as possible, and then withdrawing some of the care as the patient improves. Others advocate for a stepwise or sequential approach moving from one therapy to the next option,” says Dunkin, noting that strategies depend partly on clinicians’ understanding of obesity pathology. While any patient with a BMI of 30 or greater is eligible for ESG, it’s still too early to determine the best protocols. Either way, he adds, the expansion of the toolkit provides physicians with an “opportunity to individualize treatments for patients then work out best pathways.” And Boston Scientific continues to invest in new surgical technologies for treating obesity, including work on Axios, a lumen-opposing metal stent, which connects the stomach to other structures in the abdominal cavity and could bypass the stomach intestine downstream to get a metabolic effect.

Sidebar: Health Plans Grapple With the Economics of GLP-1s

Reimbursement for different treatments is also a moving target and plays a significant role in patient selection of procedures. While insurers generally cover traditional bariatric surgery, reimbursement is still “the Wild West” for medication therapies, says Brian Dunkin, MD, chief medical officer of Boston Scientific, Endoscopy.

Medicare has created temporary C-codes, effective July 1, 2023, for ESG and endoscopic transoral outlet reduction (TORe), a revision procedure, which map to an ambulatory payment classification paying $9,087 nationally. These codes are for use in the hospital outpatient setting only [Note: this does not refer to ambulatory surgery centers], says Boston Scientific. Since each facility has a different payment and cost structure, the budget impact will vary.

For drugs, the situation is different. Medicare and commercial insurers by and large cover GLP-1s for diabetes but draw the line at paying for use in nondiabetic, obese patients. The burden, however, is greater for commercial insurers, since the majority of obese patients seeking treatment are younger than 65 years.

Commercial insurers face challenges on several fronts. Studies show that patients regain weight after stopping treatment with GLP-1s—in some cases putting on more weight than they had before starting treatment. Will insurers therefore need to cover these drugs in perpetuity? Furthermore, long-term compliance with GLP-1s is low—up to 50% of type 2 diabetics taking these drugs discontinue use after a period of time. If that is the case, what will happen to patients when their coverage stops?

In a webinar organized in August by Digital Health New York (DHNY), a speaker noted that following Wegovy’s approval, in the first half of 2023, his plan saw a 90% increase in utilization of semaglutide, compared with the same period in 2022, and its spend on the class rose 20% from the second half of 2022 versus the first half of 2023—a figure that if annualized would be a 35% increase for 2023. These figures are skyrocketing even though the drugs are being used by only 2% to 5% of obese eligible members, he pointed out.

“Companies and governments can go bankrupt covering these drugs, so the answer is to apply guardrails,” says Katherine Saunders, MD, an expert on obesity and co-founder of IntelliHealth, a digital health platform that is working with employers to design affordable programs for covering obesity treatments. And while the drugs are “an amazing breakthrough” they are not the best option for everyone, she adds, noting “It’s definitely not the case that the meds will entirely replace bariatric surgery.”

Even so, while the medications have demonstrated impressive potency, physicians are still learning how to optimize their use in this difficult to treat patient population. Data to date shows that about 15% of patients stop using their medications due to intolerable side effects, while a similar proportion of patients do not respond adequately to their drugs, failing to achieve the minimum 5% total body weight loss that experts believe is required to impact comorbidities. Defined protocols for optimal use of medication versus surgery do not yet exist, as the field is rapidly evolving.

Sidebar: ASMBS and IFSOMD Updates Recommend Expanded Eligibility for Weight-Loss Surgery

Updated guidelines issued in late 2022 (the first updates in more than 30 years) jointly by the American Society for Metabolic and Bariatric Surgery (ASBMS) and the International Federation for Surgery for Obesity and Metabolic Disorders (IFSOMD) expand the patient population eligible for weight-loss surgery and endorse metabolic surgery for type 2 diabetics. These guidelines set standards that most surgeons and physicians treating this patient population adhere to.

Metabolic and bariatric surgery options are now recommended for individuals with a BMI of 35 or more regardless of the presence or absence of obesity-related conditions and should be considered for people with BMIs ranging from 30 to 34.9 and metabolic disease and in selected children and adolescents. Even without metabolic disease, weight-loss surgery should be considered starting at BMI 30 for people who do not improve using nonsurgical therapies, the guidelines state. Additionally, these guidelines should be adjusted for different populations, for example, with considering Asians for weight loss beginning at BMI 27.5.

The latest guidelines further state “metabolic and bariatric surgery is currently the most effective evidence-based treatment for obesity across all BMI classes” and “studies with long-term follow-up, published in the decades following the 1991 NIH Consensus Statement, have consistently demonstrated that metabolic and bariatric surgery produces superior weight-loss outcomes compared with nonoperative treatments.”

They also note that multiple studies have shown significant improvement of metabolic disease and a decrease in overall mortality after surgery and that “older surgical operations have been replaced with safer and more effective operations.”

The earlier guidelines published in 1991 suggested bariatric surgery be confined to patients with a BMI of at least 40 or a BMI of 35 or more and at least one obesity-related condition such as hypertension or heart disease. There were no references to metabolic surgery for diabetes or references to the emerging laparoscopic techniques and procedures that would become mainstay and improve the safety of weight-loss surgery. The earlier statement also recommended against surgery in children and adolescent even for those with BMIs over 40 because it had not been sufficiently studied.