ARTICLE SUMMARY:

Recent acquisitions are boosting device development in this challenging disease area. Excerpted from our recent feature article, Devices for Many-Faceted Heart Failure.

What’s the biggest unmet need in cardiovascular disease? Heart failure, at least from the perspective of medical device company representatives who spoke on the panel “New Opportunities and Directions in Cardiovascular Medical Devices,” which took place at the 2024 MedTech Strategist Innovation Summit in Dublin. Executives from Edwards Lifesciences, Johnson & Johnson, and Medtronic agreed that many patients with heart failure don’t yet have access to the right therapy, because the disease is complicated in ways that we’re only beginning to address.

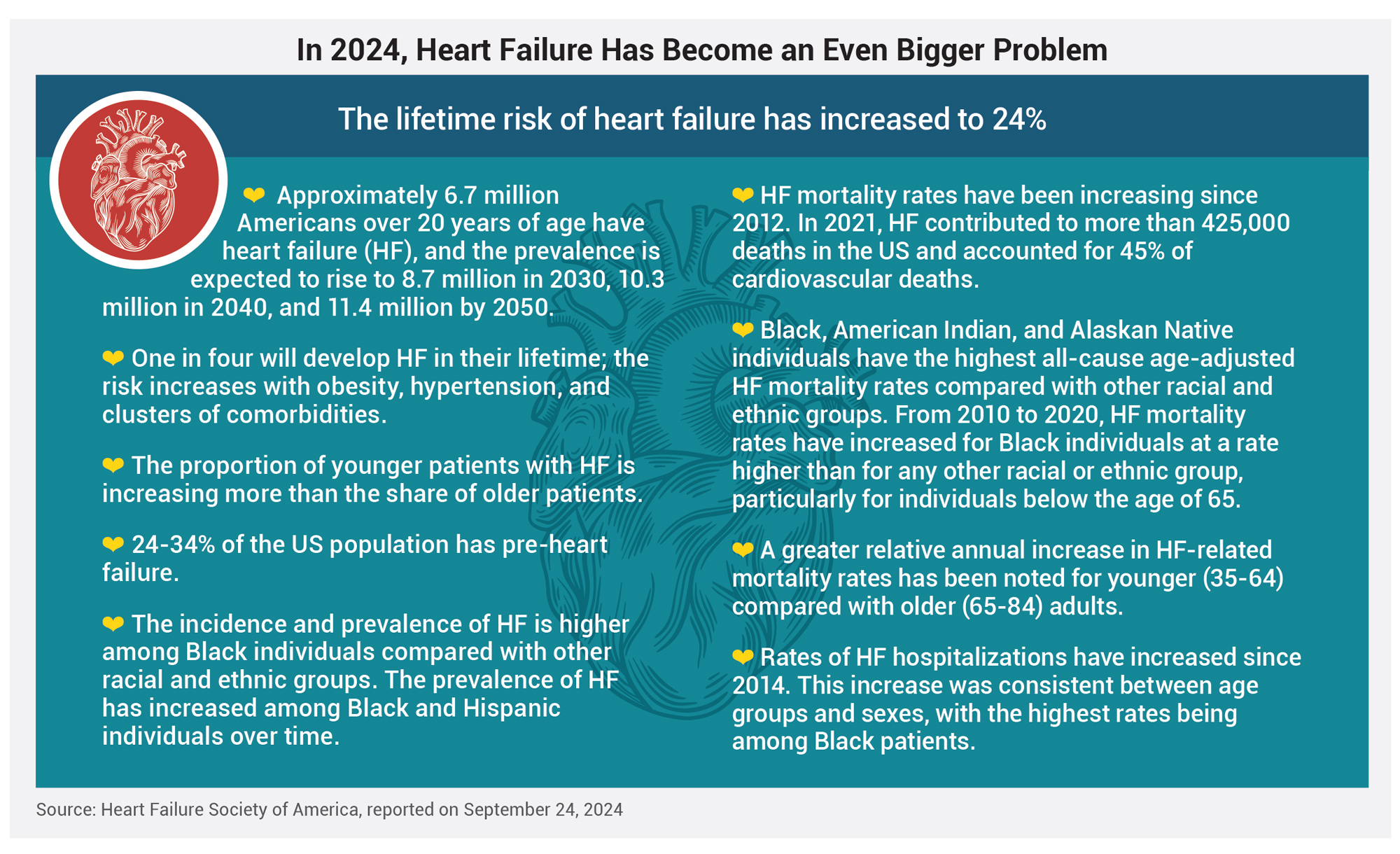

In September, the Heart Failure Society of America reported that in 2021, heart failure, which affects approximately 6.7 million people over the age of 20, was responsible for 45% of all cardiovascular deaths, and the situation is worsening (see box, “In 2024, Heart Failure Has Become an Even Bigger Problem”).

That same month, the society also issued a consensus document in the Journal of Cardiac Failure, to begin the process of creating guidelines for the use of medical devices in heart failure—not necessarily as a second-line alternative after guideline-directed medical therapy (GDMT) fails or is precluded, but right alongside medical therapy in the appropriate sets of patients. The authors make the case that devices can be beneficial because they might target specific physiological mechanisms of disease in ways that drugs can’t, and they’re also not, usually, subject to issues of adherence or metabolism the way drugs are.

That same month, the society also issued a consensus document in the Journal of Cardiac Failure, to begin the process of creating guidelines for the use of medical devices in heart failure—not necessarily as a second-line alternative after guideline-directed medical therapy (GDMT) fails or is precluded, but right alongside medical therapy in the appropriate sets of patients. The authors make the case that devices can be beneficial because they might target specific physiological mechanisms of disease in ways that drugs can’t, and they’re also not, usually, subject to issues of adherence or metabolism the way drugs are.

The Heart Failure Society felt it necessary to take this step because device therapies, even when approved with evidence that they work, are underused or not used early enough. Thus the society wants to create, for heart failure device therapies, the kind of standardized, guidelines-based approach that governs drug therapy. The authors contend that even when heart failure patients are managed by medical therapy, the residual risk of events (hospitalizations due to episodes of decompensation and death) is high enough to support combination approaches that include devices. But that’s not the whole problem. The scientific statement cites real-world studies showing that 43% of eligible heart failure patients don’t benefit from guideline-directed medical therapy for many reasons, including intolerance, nonadherence, inconsistent delivery, and the long-term cost of recurrent usage.

Given that inadequate medical therapy confers an excess risk of all-cause mortality of 29% over two years (or higher—37% when the comparison includes only concurrent medication refills), the society has set out to create a care pathway and guidelines for the timely and judicious use of devices that target specific pathophysiological mechanisms, some already approved, and many more making their way through development.

This provides tailwinds for heart failure device developers, as do recent acquisitions by the some of the strategics mentioned above, whose spokespeople were clearly not talking through their hats when they said heart failure was a priority. In August, Edwards acquired, from Genesis MedTech, JC Medical, the maker of a transcatheter valve for the treatment of aortic regurgitation, a condition that drives the progression of heart failure, after previously announcing in July that it paid $1.6 billion to acquire two other companies in the space (without disclosing what it paid for each). In the bundle was JenaValve, which Edwards bought for the potential of its transcatheter valve to treat aortic regurgitation, with FDA approval anticipated in late 2025 (see “TAVR Update: Market Leaders Medtronic and Edwards Look to Conquer New Indications and Solve Old Problems”, MedTech Strategist, September 4, 2024). Endotronix was the second company purchased. It’s Cordella sensor for monitoring pulmonary arterial pressure, which the FDA approved in June, provides an early warning of heart failure so clinicians can intervene in a timely fashion.

Johnson & Johnson had already staked a major claim to the space in December 2022 when it acquired Abiomed, the leader in mechanical circulatory support, in a deal that valued the acquisition target at almost $17 billion. In August, it entered into a new device category for heart failure treatment by acquiring V-Wave for $600 million up front with the possibility of additional regulatory and commercial milestone payments totaling $1.1 billion. V-Wave is a leading player in the interatrial shunt space, having reported early results from its pivotal trial in April.

These events are giving a much-needed boost to a medtech development category that, while offering compelling products for an enormous market, is extremely challenging.

Excerpted from Devices for Many-Faceted Heart Failure, MedTech Strategist, October 23, 2024.