ARTICLE SUMMARY:

Medtech investments and dealmaking was down in 2023. An expert panel of VCs discusses coping strategies and reasons for optimism. Excerpted from our recent feature, Medtech by the Numbers.

Each year, at MedTech Strategist’s Innovation Summit in Dublin, we present “MedTech by the Numbers,” a panel session where we ask VCs to identify trends inherent in the previous year’s investment and M&A activity. At this year’s summit in April, Jennifer McMahon presided over the panel. A partner at Seroba, which invests in biotech and medtech with a main concentration in Europe (and with a reach to North America), McMahon brought together four VCs with different perspectives, although all invest in medtech to some degree: Inga Deakin, a principal at London-based Molten Venture, Megan MacDonagh, a VP at SV Health Investors, Anne Portwich, PhD, a partner at EQT Life Sciences, and Sylvain Sachot, PhD, a partner at Barcelona-based Asabys Partners.

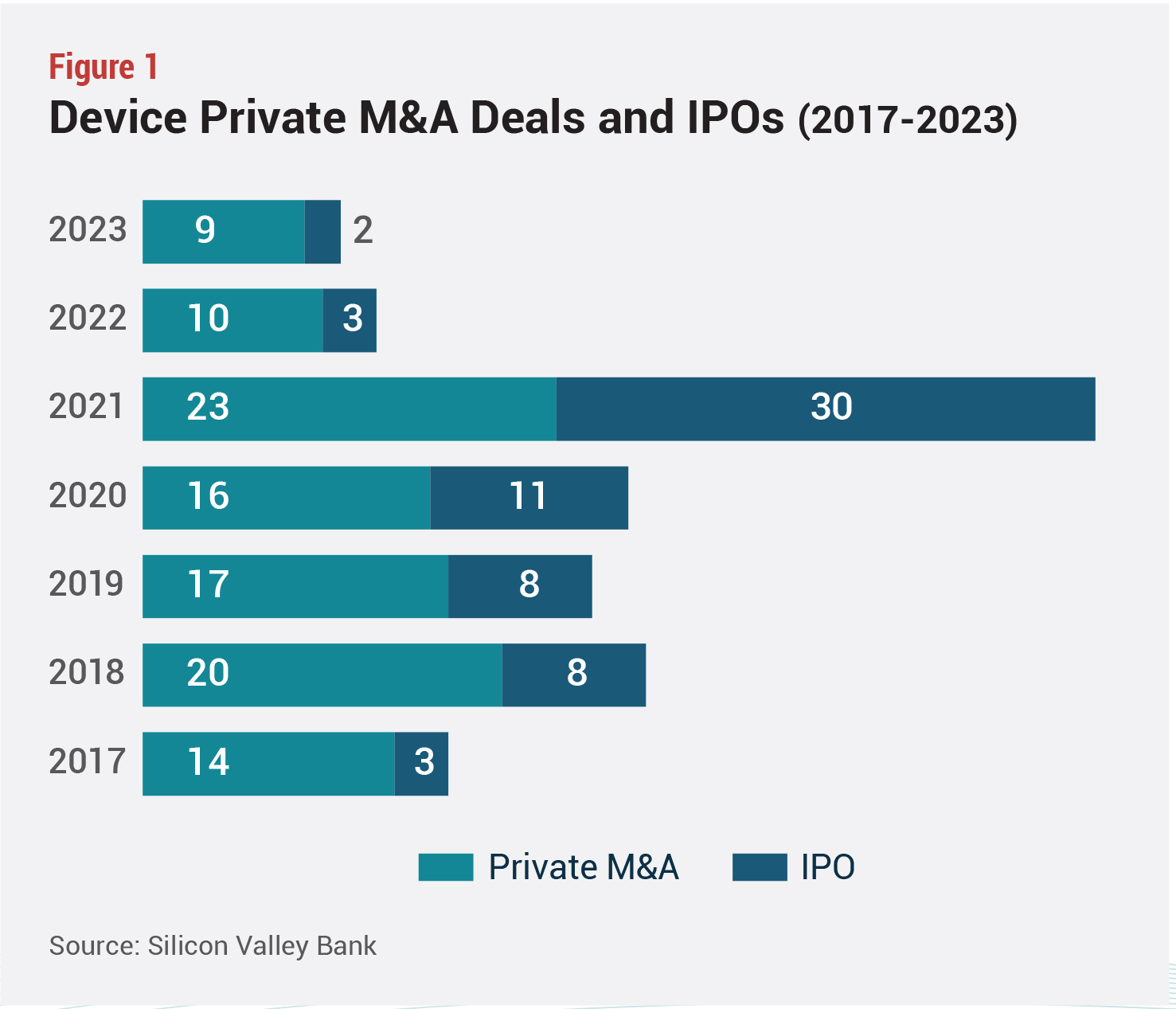

To set the stage for the discussion, we consulted Silicon Valley Bank’s (SVB) 2023 annual report, “Healthcare Investments and Exits,” covering biopharma, healthtech, diagnostics, and medical devices (see Figure 1). 2023 saw a continuation of the decline—for medtech, in deal volume, size of funding rounds, and  valuations—that began after a peak year in 2021. The phenomenon wasn’t limited to medical devices, however. According to the SVB report, taking into account all healthcare sectors, the level of investment was down 55% from the 2021 peak, and on the whole, the IPO market was flat, compared to 2022.

valuations—that began after a peak year in 2021. The phenomenon wasn’t limited to medical devices, however. According to the SVB report, taking into account all healthcare sectors, the level of investment was down 55% from the 2021 peak, and on the whole, the IPO market was flat, compared to 2022.

Venture capital allocated specifically to device companies (in both the US, EU, and UK) dropped off by 25%, as compared to the previous year, and diagnostics and tools struggled even more to get funding, receiving 42% less capital, year on year. In the medical device sector, Series A rounds were fewer, smaller, and valued the company less than the previous year; 142 early-stage rounds raised $684 million in 2023, compared to 137 medtech deals in the previous year, which garnered $971 million. And the median seed/Series A pre-money valuation was down in 2023.

Are we simply seeing a reset, after a spike in 2021 that contributed to overinflated valuations, or are we heading into a new normal that calls for stoicism and creative problem-solving, or both?

Continue reading this story here.