ARTICLE SUMMARY:

With a suite of minimally invasive reproductive-assist devices, Femasys may be poised to be the first big success in women's health. Excerpted from our recent feature article.

Those who develop medical interventions for needs particular to women face a vicious cycle of underfunding that delays the progress of innovation or stymies it altogether. Explanations for this vary; perhaps it’s the historical (pre-1990) lack of enrollment of women in clinical trials and the resulting paucity of clinical data specific to females, or the male domination of venture capital and the simple fact that people are more comfortable with what they understand. Even today, only 26% of general partner investors are women, according to “Femtech: Posed for Growth,” a 2024 report by Deloitte. There is an overhang as well, caused by some high-profile medical device failures in women’s health (i.e., morcellator safety issues and the safety issues that led to the recall of the Essure permanent contraceptive sold by Bayer). In a field with fewer innovative start-ups than, say, cardiology, these missteps loom large.

Today, one often reads that women’s health is finally having its moment, and that might be true politically, especially as this is an election year. In the US, we saw the announcement, in November 2023, of the White House Initiative on Women’s Health Research. But in terms of medical device investment, are things really changing?

Newsletters like Femtech Insider continually report on funding rounds for women’s device companies with great ideas, but these are usually low single- to low double-digit deals; most of the money in women’s health is going to digital health and services. While these service providers might ultimately help medical devices by streamlining access to patients and providing new payment models, medical device start-ups still struggle in this space.

To put some hard numbers on it, Silicon Valley Bank’s 2023 report “Innovation in Women’s Health” noted that it is surprising “the consistency with which women’s health companies are valued lower than healthcare companies overall.” This discount, according to the report, applies to women’s health companies regardless of stage or focus area. Since 2019, the median valuation discount for women’s health in biopharma compared to an average of all healthcare sectors is 41% for the early-stage company, and 52% for the late-stage enterprise. For the medical device sector, women’s health companies are discounted by 43% at the early stage, and 4% at late stages.

What the market needs is a big success story: an innovative start-up that grows new product categories sufficiently to become a strategic acquirer in its own right. Femasys has that potential. It has managed to fund its homegrown women’s health device innovations for 20 years, through $100 million in private funding and an initial public offering in 2021 (the company trades on NASDAQ and has a current market cap of $24 million). Now, as it prepares for the launch of its four approved products, Femasys just might have the momentum to be that story.

This women’s health company embodies the medical device principles that have succeeded in other specialties—the goal of increasing safety and access and decreasing costs with minimally invasive, office-based devices, while targeting enormous markets that have not seen innovation in decades.

Operating in infertility, permanent contraception, and the diagnosis of cervical cancer, Femasys finds that time has shown its interventions to be the right ones for a changing politico-legal climate around the storage of embryos (its infertility product might help couples succeed before they need to resort to in vitro fertilization and the creation of embryos) and the restriction of abortion after the overturn of Roe v. Wade. Its permanent contraceptive will help couples avoid unwanted pregnancies.

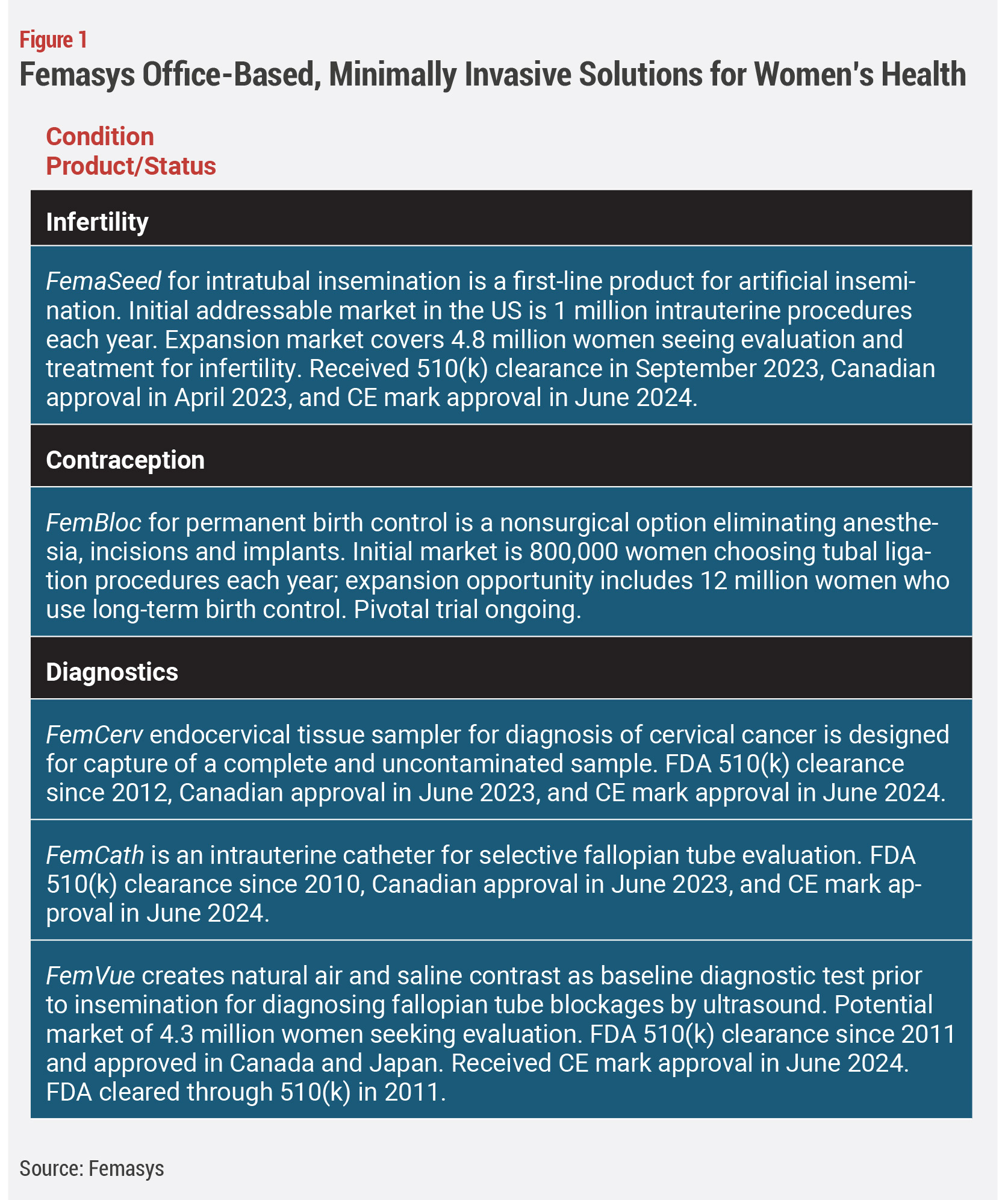

The company’s aid for cervical cancer diagnosis is also spot on at a time of rising rates of cervical cancer in the older population of women who couldn’t benefit from the HPV vaccine. In fact, Femasys founder and CEO Kathy Lee-Sepsick was invited to speak to the White House’s Office of Science and Technology Policy about the Cancer Moonshot and the company’s product FemCerv (see Figure 1).

The company’s aid for cervical cancer diagnosis is also spot on at a time of rising rates of cervical cancer in the older population of women who couldn’t benefit from the HPV vaccine. In fact, Femasys founder and CEO Kathy Lee-Sepsick was invited to speak to the White House’s Office of Science and Technology Policy about the Cancer Moonshot and the company’s product FemCerv (see Figure 1).

Now, thanks to recent approvals, Femasys has four products ready to sell in the US, Europe and Canada, addressing initial markets worth $3 billion with much larger expanded markets ahead, and another potentially large hit in pivotal clinical trials. The products it has developed are covered by some 180 patents.

The company has been building for this moment for more than two decades, notes Lee-Sepsick. It’s now ready to address large markets with unmet needs while serving a trend of minimally invasive, office-based procedures. It has safe and effective products with regulatory clearances, control over their manufacture, and is ready to sell them to fertility clinics, as a prelude to making them available to ob/gyns.

Femasys is ready for take-off. How accelerated the trajectory will be depends on money, which, as noted, is difficult to come by in this space. But Lee-Sepsick makes the case that it’s the right women’s health company for the times.