ARTICLE SUMMARY:

New technologies are flourishing in the diagnostics industry, but finding money to fuel that innovation is getting tougher. Excerpted from our recent feature article, Diagnostic Start-Ups Post-COVID Reality.

An onslaught of technological innovation highlights the foundational role diagnostic testing has in advancing clinical care and improving patient’s lives. Insights gained from the COVID era, a more open-minded approach to home testing, and advances in spatial biology, single-cell analysis, digital pathology, multiomics, artificial intelligence, and machine learning are major contributors. New tests that integrate multiple modalities to accelerate precision medicine by identifying which patients are most likely to benefit from specific treatments and the prognosis of those patients have been especially impactful. In some cases, reimbursement has been attractive. Those achievements are hardly translating into greater interest in financing start-ups, where so much of the innovation occurs.

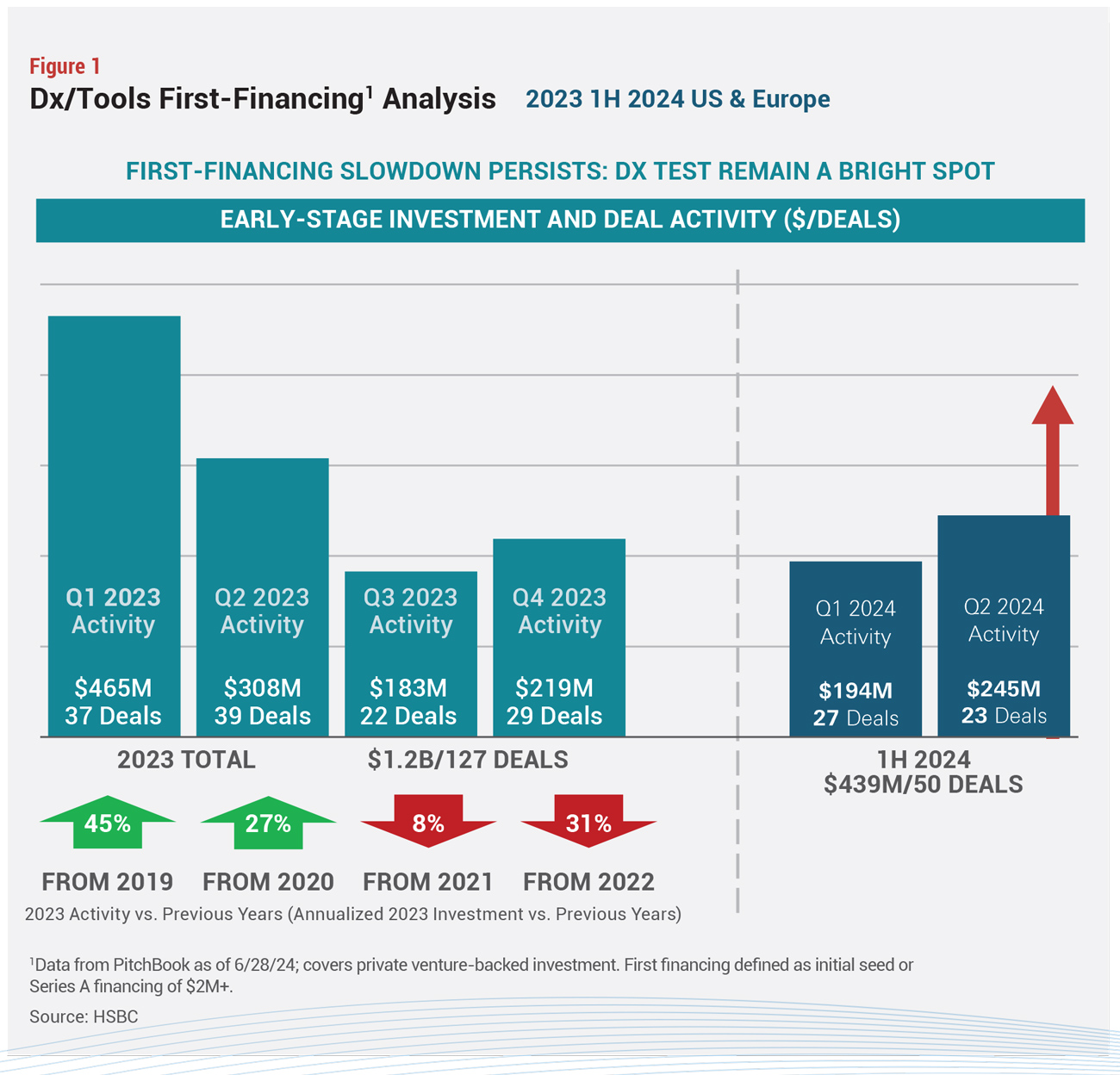

Two perspectives on these contradictory claims are evident from a recent report on venture investing in healthcare by HSBC, and from a summit on diagnostic testing held at Arizona State University (ASU). The former showed how financing levels for R&D tools and diagnostic testing companies have dropped from 2023 through the first half of 2024, since peaking during COVID, although they remain higher than their pre-pandemic levels. The bank hasn’t published numbers yet for the third half of 2024, but those should be similar to amounts for the first two quarters of this year, says Jonathan Norris, managing director at HSBC’s Innovation Banking.

More specifically, investors committed a total of $439 million to diagnostic and tool companies seeking seed or Series A financings of $2 million or more in the first half of 2024, down from $773 million in the same period of 2023, according to HSBC. There were 50 versus 76 deals, respectively, during those  periods (see Figure 1). Although diagnostic testing continues to advance in terms of technological and regulatory innovations, early-stage company investment is declining due partly to investors’ focus on “optimizing their existing portfolios in preparation for the next round of financing or an exit, even as those options are deemed riskier,” HSBC said in its 1H 2024 Innovation Report. Limited public market access and poor IPO performance from prior investments have caused investors to retreat, although the second quarter of 2024 saw a modest uptake, led by four large diagnostics first financings, the report said.

periods (see Figure 1). Although diagnostic testing continues to advance in terms of technological and regulatory innovations, early-stage company investment is declining due partly to investors’ focus on “optimizing their existing portfolios in preparation for the next round of financing or an exit, even as those options are deemed riskier,” HSBC said in its 1H 2024 Innovation Report. Limited public market access and poor IPO performance from prior investments have caused investors to retreat, although the second quarter of 2024 saw a modest uptake, led by four large diagnostics first financings, the report said.

A huge spurt in financing occurred during COVID as nontraditional investors moved into the area, but those have not ended well because of their focus on COVID-specific testing, says Norris. Since then, two areas of greatest interest to investors have been sepsis diagnostics and liquid biopsies.

The decline has been even steeper for R&D tools compared to clinical diagnostic testing, despite lower regulatory risk, because buyers of tools platforms are not willing to pay the high prices they are being charged, says Norris. Pilot studies for new products in this subsector have not converted to full commercialization for that reason. This down-the-road challenge is hampering early-stage investing, too, he adds.

Investors in the R&D subsector therefore know they have to fund their portfolio companies through early commercialization, when crossover investors and private equity might step in, which is a change compared with previous years, according to Norris.

Exit deal values these days average between $150 million and $200 million, which won’t work when investors are expected to commit up to $100 million or more over 5, 6, or 7 years, Norris continues. Some tools companies that undertook initial public offerings (IPOs) a few years ago are doing well, like 10x Genomics, which has single-cell and spatial biology platforms, and Twist Biosciences, which has a synthetic engineering platform. Both companies, which went public in 2021 and 2018, respectively, captured lofty market valuations of over $1 billion at some point (although not at their IPOs).

Continue reading Diagnostic Start-Ups Post COVID Reality here.